CEO

September 2020

The global COVID-19 pandemic has been ravaging the world throughout 2020. Please let me extend my thoughts and prayers to everyone who has fallen victim to this virus or had their lives otherwise affected. We still do not have a vaccine or adequate treatments, and it is said that it could take anywhere from between 18 months and three years for this crisis to come to an end. The pandemic is already changing our lives, and the longer it continues, the greater the impact that it will have on society and the economy.

The world after the COVID-19 pandemic is not something we must predict, but rather something that will be shaped by our intentions today. Will we try to revive the world seen before the pandemic? Or, will we try to shape a new economy and society by rethinking our approach toward capitalism, which was showing its limitations even before the pandemic? We are being urged to seize the opportunity created by the pandemic to undertake a Great Reset and formulate a new vision for the period after the pandemic.

MARUI GROUP is practicing management from a long-term perspective with the goal of promoting harmony between the interests and happiness of all of its stakeholders. We are therefore pressed to formulate a vision for how we will respond to the COVID-19 pandemic and for how we will approach the period thereafter.

Today, I would like to talk about the current impacts of the COVID-19 pandemic and our future outlook in this regard and our long-term course for after the conclusion of the pandemic.

COVID-19 Impacts and Future Outlook

In the fiscal year ended March 31, 2020, revenue declined 2% year on year as the COVID-19 pandemic forced us to shorten store hours and drove down credit card use. Operating income, meanwhile, rose 2%, making for our 11th consecutive year of growth in operating income. Net income attributable to owners of parent also rose, for the ninth consecutive year, despite extraordinary losses incurred due to expenses associated with the pandemic. Moving on to the fiscal year ending March 31, 2021, our operations have been heavily impacted so far as Japan's state of emergency declaration, which was issued in April 2020, forced us to close nearly all of our stores for a period of roughly two months. Closing stores for two months is quite unprecedented, with the only comparable instances in the nearly 90-year history of MARUI GROUP coming during and immediately after World War II. Accordingly, we are projecting year-on-year declines of 20% in revenue and 72% in net income attributable to owners of parent.

This outlook caused the Company's stock price to temporary drop by nearly 45% compared to six months prior. I apologize for the concern this volatility has caused for our shareholders and other investors. I would thus like to take a moment to explain our efforts toward stakeholders in relation to the pandemic and our future performance forecasts.

Efforts Toward Stakeholders

When the Japanese government issued its state of emergency declaration in early April 2020, we made the decision to close all of our stores in a move to ensure the safety of our customers and employees. At the head office, we have been preparing for a transition to teleworking since 2019, and a teleworking system was thus immediately deployed throughout the office. We were thereby able to protect the safety of our customers and employees, but we at the same time found ourselves in a difficult situation with regard to how to accommodate our business partners. It was us who decided to close our stores. While our tenants cooperated with this decision, it meant that they too could not open their stores. This situation was compounded by the fact that around 80% of our tenants are small to medium-sized companies.

MARUI GROUP's officers were assembled to discuss what we could do for these business partners. We recognized the trouble they faced as the sudden state of emergency declaration had forced them to close their stores with no clear indication of when they could be opened again, no doubt creating issues in terms of funding. The idea of lowering rent was proposed, but we had no prior experience or standards based on which to determine the amount by which to reduce this rent. The possibility to halve rent, to share the burden of the situation equally with our partners, was put forth. However, as their income was zero over this period, it did not seem fair for us to receive even half of rent payments. Discussions were at a deadlock.

It was then that we were reminded of the importance of exercising the co-creation advocated by MARUI GROUP, especially given these difficult times. We thus decided to roll out a partnership enhancement campaign for overcoming the COVID-19 pandemic together. One facet of this campaign was a complete cancellation of rent payments during the period of the store closures. However, this campaign was not without its concerns. Rent at MARUI GROUP differs from other commercial facilities, where rent is often tied to sales; the vast majority of our stores employ fixed rent fees, which are decided by contracts. Accordingly, a rent cancellation was tantamount to debt forgiveness. Such an act thus brought with it the risk of upsetting shareholders as, giving up on the rent revenues promised in contracts, would adversely impact their interests.

However, even though this move would result in large shortterm losses, the stronger ties with our business partners had anticipated economic benefits over the medium-to-long term. We therefore endeavored to explain this fact to shareholders and other investors and to gain their understanding. Putting forth this idea at the Ordinary General Meeting of Shareholders, we were successful in earning the understanding of shareholders, and this understanding enabled us to cancel rent to the joy of stakeholders.

This measure had unexpected results, namely words of admiration being levied at employees. Apparently, our decision prompted words of understanding and encouragement for our employees from family members, friends, associates, and customers. We were thereby able to foster a sense of solidarity and raise morale to propel us forward as we seek to overcome the pandemic.

This experience taught us how, in times of crisis, we are pressed to exhibit the true value of the principles we espouse and to demonstrate our commitment to these principles. We are now poised to enter the stage of full-fledged co-creation. With these important lessons at heart, we are fully committed to co-creating value together with stakeholders.

Future Outlook

In the three months ended June 30, 2020, net income attributable to owners of parent dropped by more than 70% year on year. The primary reason behind this drop was the aforementioned cancellation of rent payments during the period of store closures. Conversely, operating income was up 1%. This outcome was due in part to relegating certain expenses to extraordinary loss. However, there were also two other factors that contributed to this increase in operating income.

The first was a rise in operating income in the FinTech segment. This rise does not mean that the FinTech segment is performing well. Quite the contrary, transaction volumes were down 10% due to the COVID-19 pandemic. However, the FinTech segment operates a business in which variable costs outweigh fixed costs. We were thus able to reduce costs to an extent that exceeded the drop in revenue, thereby securing a nearly 20% increase in operating income. This structure is the exact opposite of retailing operations, which have high fixed costs and low variable costs. MARUI GROUP was thus able to overcome this adversity by offsetting the negative impacts of the adverse situation with the positive benefits thanks to its business model integrating retailing and fintech. This model is a major difference between MARUI GROUP and companies that are devoted purely to retailing.

The second factor is the new earnings structure that we had built through the business structure reforms advanced thus far. In explaining this structure, I would like to elaborate on two new indicators for which we began disclosing figures in the six months ended September 30, 2019: recurring gross profit and contracted future recurring gross profit.*1 Let me begin with the background that led to the disclosure of this information. MARUI GROUP began offering EPOS cards in 2006, causing fintech to replace retailing as the driver of its growth. Later, we embarked on a five-year venture to transition to a business model focused on fixed-term rental contracts in the Retailing segment in the fiscal year ended March 31, 2015. This transition entailed moving away from conventional department stores to operate shopping centers that primarily generated income in the form of rent revenues. These business structure reforms were aimed at departing from short-term-perspective management focused on earnings on a single fiscal year basis to long-term-perspective management emphasizing lifetime value. Through this transaction, we were able to grow recurring revenue, a form of long-term earnings generated through ongoing transactions with customers and business partners.

Specifically, this recurring revenue took the form of store real estate rent revenues as well as commissions from recurring payments for rent guarantees, communications fees, and utilities and revolving and installment payments in the FinTech segment. Recurring revenue has seen a sharp rise since the transition to fixed-term rental contracts in the fiscal year ended March 31, 2015. As a result, the portion of gross profit represented by recurring gross profit grew from 34% in the fiscal year ended March 31, 2014, to 65% in the fiscal year ended March 31, 2020, and the amount of this recurring gross profit increased by 2.5 times. This means that more than 60% of the gross profit generated in the fiscal year ended March 31, 2020, can be expected to recur in subsequent fiscal years.

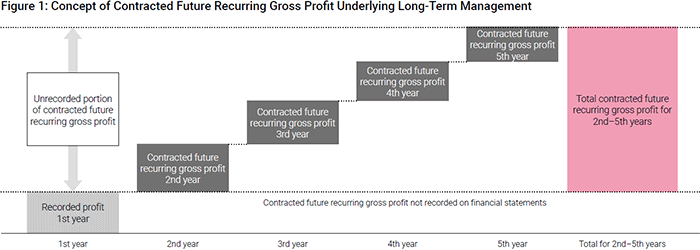

The new second indicator is contracted future recurring gross profit, which represents the gross profit to be generated in fiscal years after the one in which a recurring gross profit transaction is conducted. For example, if a customer were to conclude a five-year contract in a given fiscal year, we would only record the revenue incurred in that given year. Accordingly, there would remain four years' worth of outstanding revenue that is not recorded on the financial statements. We began disclosing contracted future recurring gross profit with the aim of making this four years' worth of outstanding revenue readily apparent (see Figure 1). The amount of contracted future recurring gross profit from transactions concluded in the fiscal year ended March 31, 2020, to be recorded in subsequent fiscal years was 2.7 times greater than the amount of recurring gross profit recorded in this year. In other words, we can still anticipate gross profit in an amount 2.7 times greater than the figure in the fiscal year ended March 31, 2020, to be incurred in the future. To put it more bluntly, even if we are unable to resume our operations for an extended period of time due to the COVID-19 pandemic, we could still look forward to nearly three years' worth of gross profit thanks to our business activities thus far.

In this manner, our efforts to shift toward management emphasizing lifetime value has granted us a more robust earnings structure than ever before while also increasing our confidence in our future cash flows. This confidence is apparent in our decision to disclose a dividend forecast projecting higher dividend payments, despite performance forecasts being left undecided. As for performance forecasts, there are causes for both pessimism and optimism when it comes to performance in the fiscal year ending March 31, 2021, and this performance will be heavily impacted by the COVID-19 pandemic. Although we cannot rationally estimate performance at this moment in time, we are so confident in our future cash flows that we believe it will be possible to raise dividend payments even based on the most pessimistic outlook.

We have continued to communicate our policy of placing ongoing, long-term dividend increases as a top priority to our shareholders. Nevertheless, we received a question regarding the decision to forecast higher dividend payments despite the lack of full-year performance forecasts at a financial results briefing. We responded that the decision was founded on our commitment to live up to the expectations of shareholders regardless of the profit losses stemming from the COVID-19 pandemic.

*1 Referred to as "contracted future recurring revenue" until the fiscal year ended March 31, 2020, to reflect future recurring revenue based on revenue as displayed on financial statements; referred to as "contracted future recurring gross profit" thereafter to reflect future recurring revenue based on gross profit

Long-Term Course for After the COVID-19 Pandemic

In the face of a crisis, our long-term perspective prompts us to view the crisis as an opportunity to reflect on our founding spirit, reexamine the essence of the value we provide, and redefine this essence based on the changes in the opportune environment. We take this proactive approach in place of passive approaches such as waiting for the crisis to pass or drafting policies for minimizing its impacts. MARUI GROUP was faced with a management crisis that persisted from 2007 to 2014, and we continued to redefine the Company throughout this period.

I would now like to discuss how we redefined MARUI GROUP and the company we aim to become in the face of the unprecedented crisis of the COVID-19 pandemic. This vision can be consolidated into two ideas: evolution into an intellectual creation company and growth of corporate value through harmony between the interests and happiness of stakeholders.

Evolution into an Intellectual Creation Company

One of the megatrends to which MARUI GROUP is paying the greatest attention as it charts its future course is the shift from tangible assets to intangible assets. Intangible asset holdings grew to surpass tangible asset holdings in the mid-1990s in the United States and in the United Kingdom in the early 2000s. Intangible asset holdings are set to exceed tangible asset holdings in Sweden and Finland as well. In Japan, meanwhile, intangible asset holdings are only around half of tangible asset holdings, a level similar to that seen in Italy and Germany. Moreover, the combined market capitalization of intangible asset leaders Alphabet Inc.; Amazon.com, Inc.; Facebook, Inc.; Apple Inc.; and Microsoft Corporation is estimated to be higher than the GDP of Japan.

MARUI GROUP is leaning toward the intangible asset side. At the financial results briefing for the fiscal year ended March 31, 2016, which coincided with the launch of our medium-term management plan four years ago, we showed a graph describing MARUI GROUP's business structure reforms. This graph showed intangible operating receivables in the FinTech segment moving to surpass land, stores, and other tangible assets in the Retailing segment. As such, the graph represented the FinTech segment replacing the Retailing segment, which had been our growth driver since our founding, as the new primary growth driver.

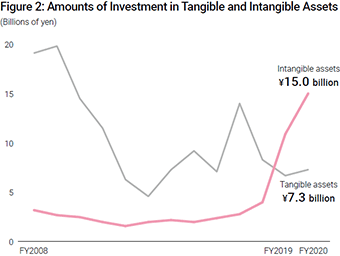

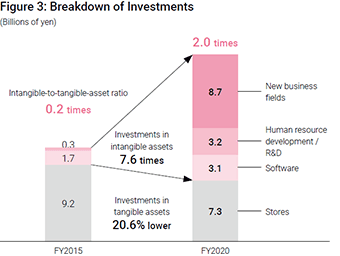

Total intangible assets exceeded total tangible assets in the fiscal year ended March 31, 2019 (see Figure 2). Moreover, the amount of intangible assets on March 31, 2020, was 7.6 times higher than five years earlier and double the amount of tangible assets (see Figure 3). These figures are a result of investments in stores declining following the shift to fixed-term rental contracts while we ramped up investments in software, human resource development, research and development, and new business fields. Software investment is rising in conjunction with the growth of the FinTech segment. We have continued to increase investments in human resource development and research and development, although these investments are not clearly apparent on our financial statements as they are treated as expenses. Human resource investments are an area of particular focus, especially when it comes to fostering IT staff, seconding employees to venture company investees, and cultivating future leaders. As for investments in new business fields, we have invested a total of ¥15.7 billion, primarily in venture companies, over the past four years.

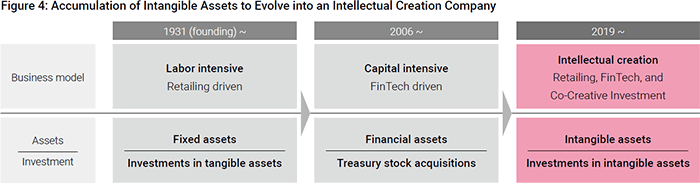

Based on these factors, I would now like to discuss the course we will be taking going forward. Since its founding, MARUI GROUP has continued to grow through a business model driven by retailing. Retailing is a labor-intensive business centered around tangible assets and investments in said assets. However, this all changed with the launch of EPOS cards in 2006, after which our fintech operations became the main proponent behind our growth. Fintech is a capital-intensive business in which fund procurement is primarily performed through debt. Going forward, we intend to further promote the shift to intangible assets to evolve into an intellectual creation company and heighten our corporate value (see Figure 4).

To this end, we are developing a new business model integrating retailing, fintech, and now co-creative investment and seeking to generate synergies between these areas to create value that is greater than the sum of its individual constituents. To MARUI GROUP, co-creative investment is like a vinyl record, having an A-side and a B-side. The A-side is growth support investment, which entails investing in venture companies that share our philosophy and vision and with which we can collaborate. To these venture companies, we provide access to MARUI GROUP's resources, namely its stores, staff, and EPOS cardholder base, and pursue collaboration to drive growth at the investee and in our investment returns.

Specific investees include e-commerce companies like BASE, Inc.; direct-to-consumer (D2C) brands such as FABRIC TOKYO Inc. and BULK HOMME Co., Ltd.; and financial inclusion companies Gojo & Company, Inc., and CROWD CREDIT, Inc. The internal hurdle rate for investment decisions in venture companies is to maintain an overall internal rate of return (IRR)*2 of 10% or more. Currently, we are seeing IRR of 30% on an individual investee basis, and our success rate in these investments is around 30%. We aim to raise this success rate though co-creation to achieve an overall IRR for all investments of more than 10%.

*2 Rate calculated using recent procurement prices for applicable marketable securities and based on amounts if listed stocks were to be sold at the end of the respective fiscal year

The B-side of co-creative investments is investments that synergize with our main business. By investing in companies and new businesses entailing superior intangible assets, we aim to incorporate these assets into MARUI GROUP. We will also pursue synergies through collaboration with such investees. Returns on these investments are anticipated to come in the form of earnings contributions to our main business.

The first B-side "song" has already been released: our anime business. This new business was launched four years ago when we participated in the production committee for a major anime movie, which led to investment and various collaborative ventures. Over the period from encompassing the fiscal years ended March 31, 2016 to 2020, we invested a total of ¥120 million in anime movies, and these investments contributed ¥4.3 billion to consolidated operating income. Based on these results, we recognize that these efforts have generated significant returns through synergies with our main business.

Other B-side investees include anime-related e-commerce retailer A-too inc., sustainability companies Minna-denryoku, Inc., and Nature Innovation Group Co., Ltd., and new business company tsumiki Co., Ltd. We intend to conduct investments in venture companies that are not anticipated to make an initial public offering and in listed companies in cases in which synergies can be expected. As one specific new investment, we commenced a capital and business alliance with TSUKURUBA Inc., a renovated housing distribution platform holder, in July 2020.

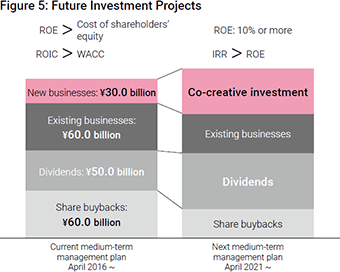

Our projection for overall investments going forward given the current situation is that investments in existing businesses will decline while co-creative investments nearly double (see Figure 5). This projection is based on the assumption that core operating cash flow will increase by roughly 20% over the five-year period beginning with the fiscal year ending March 31, 2022. As for shareholder returns, share buybacks will be cut roughly in half while dividends double. We have already achieved the goals of the medium-term management plan of posting return on invested capital (ROIC) exceeding weighted average cost of capital (WACC) and return on equity (ROE) surpassing cost of shareholders' equity. Accordingly, we will be working toward increased corporate value going forward by targeting ROE of 10% or more and an IRR that is above that level.

More information can be found in the video explaining the financial results briefing for the fiscal year ended March 31, 2020. For details, please refer to "3. Future Developments."

Growth of Corporate Value through Harmony between the Interests and Happiness of All Stakeholders

Stakeholder capitalism is gaining attention as a new approach to corporate management to replace the conventional approach of shareholder capitalism. The definition of corporate value MARUI GROUP put forth in its Co-Creation Management Report 2016 constituted a declaration of our commitment to stakeholder capitalism. At the time, we only defined five groups of stakeholders: customers, investors, business partners, communities and society, and employees. Later, "future generations"was added to this scope as a sixth group of stakeholders in conjunction with the publication of VISION BOOK 2050 in 2019.

The realization that future generations was also an important group of stakeholders arose when examining potential initiatives for addressing environmental issues. It was the work of 20th-century U.S. genius Richard Buckminster Fuller that led me in this direction. Fuller defined wealth as the number of forward days we are physically prepared to sustain for future generations. This definition made me aware of the fact that future generations were indeed the stakeholders we served by addressing environmental issues.

Reading Lounge—Engaging with Books (Book Recommendations by President Aoi) #001 Operating Manual for Spaceship Earth

Another change that was made was to our definition of corporate value. Specifically, we added one word to the definition of corporate value put forth in Co-Creation Management Report 2017. This word was "happiness." We have previously defined corporate value as "harmony between the interests of all stakeholders," but this definition was revised to be "harmony between the interests and happiness of all stakeholders." The idea of focusing on both interests and happiness came to mind as we sought means of co-creation with stakeholders.

On the topic of stakeholder capitalism, for example, polls have that roughly 60% of millennials expect companies to prioritize the resolution of social issues above the pursuit of profit. The desire for companies to focus on resolving social issues as opposed to just generating profit is probably shared around the world. In the background of this desire, no doubt, lies the fact that shareholder capitalism, which urges companies to maximize shareholder returns, widens income gaps, destroys the global environment, and causes indescribable senses of suffering and isolation to the people in developed nations who are supposed to be receiving the benefits of this approach.

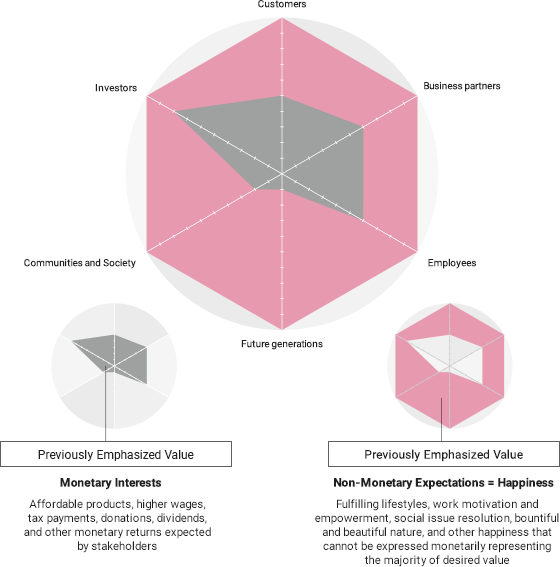

Looking back at our six groups of stakeholders from this perspective, we could not help but feel that the monetary returns expected by shareholders were likely to be almost inconsequential to other groups of stakeholders. We therefore formulated a theory to be used in discussing this matter with stakeholders. Along with this theory, we prepared a radar chart that indicated the expected degree of concern for monetary interests among each of the six groups of stakeholders (see Figure 6). I would now like to discuss our interpretation of this chart.

Investors, of course, expect monetary returns. However, the recent rise of investment focusing on environmental, social, and governance (ESG) factors tells us that investors are not solely concerned with monetary returns. Therefore, if we seek to fully meet the expectations of investors, we will be unable to do so if we focus only on monetary interests.

Customers, similarly, do not only want quality products and services that can be bought at more affordable prices. They also have an increasing desire for these products and services to provide experiences that enrich their lives. Employees are the same; they don't just want higher wages, but also to be motivated in their work. For business partners, transaction conditions are important. However, they also seek partnerships in which both parties help each other in times of need and grow by tackling challenges together. For communities and society, it is not enough to simply pay taxes or make donations; people want companies that help resolve community and social issues. Future generations, meanwhile, primarily need us to leave them a rich, pristine natural environment. There is almost no concern for monetary interests with regard to this stakeholder group.

Based on this view, we came to realize that a focus on responding to stakeholder expectations through monetary interest would overemphasize shareholders and that other stakeholder groups could be thought to be largely concerned with value other than monetary interests. We dubbed this value "happiness." However, I do not believe that the interests and happiness of stakeholders are disconnected. At MARUI GROUP, we seek to contribute to both interests and happiness, as opposed to sacrificing one for the other. This is because the two are actually connected.

Let's look at it this way: if we can contribute to customer happiness through the provision of experiences that enrich their lives, it will increase the lifetime value of our business and in turn heighten the motivation of employees. When these motivated employees work to tackle social and environmental issues through our business, it will boost the happiness of communities and society and future generations while also contributing to the interests of the business partners that are our co-creation partners. This process will also improve our scorecard when it comes to ESG factors, which are linked to the interests of shareholders.

In this manner, stakeholder interests and happiness are linked. If we so desire, we can strengthen this link to make further contributions to the interests and happiness of stakeholders.

With this, I would like to conclude this discussion of how we will pursue the growth of corporate value through harmony between the interests and happiness of all stakeholders. I look forward to co-creating with you as we march toward this long-term target.

Figure 6: Theoretical Radar Chart of

Interest and Happiness Value Sought by Stakeholders

- Relevant Links

-

- Investor Relations: Medium-Term Management Plan

- Investor Relations: MARUI GROUP's View on Corporate Value