Business Model

As of November, 2021

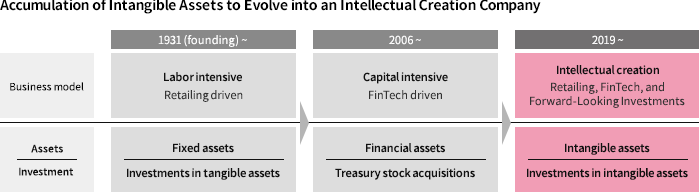

Since its founding, MARUI GROUP has continued to innovate and evolve its unique business model, which merges retailing and finance, and the structure of its business in line with changes in the times and in the needs of customers. MARUI GROUP was created in 1931 by Chuji Aoi. At that time, MARUI GROUP's business involved selling furniture through monthly installment payments. Monthly installment payments entail providing both products and credit, or, in other words, represent a business model that merges retailing and finance. This business model has continued to be passed down through the MARUI GROUP's operations, guiding its business and evolving amid changes in the times and in MARUI's products and stores. In recent years, the role of retailing and finance in this business has been revised, with fintech becoming the primary driver of growth.

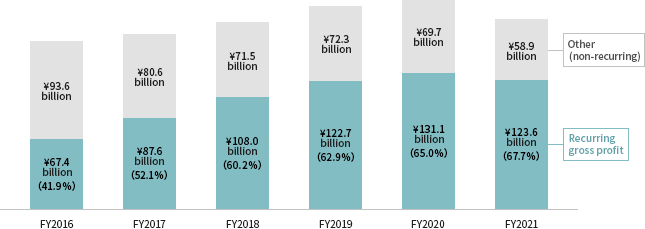

MARUI GROUP has been progressively transitioning away from a business model focused on single-year revenues toward a model that generates consistent earnings through recurring transactions. As a result, an increasingly large portion of overall revenues is being accounted for by recurring revenue,* i.e., revenue produced on an ongoing basis through contracts with customers and business partners.

* Recurring revenue is revenue generated on a recurring basis through contracts with customers and business partners. Examples of recurring revenue include rent revenues in the Retailing segment and rent guarantee revenues, finance charges on revolving and installment payments and cash advance interest, and annual enrollment fees from EPOS card use in the FinTech segment.

Business Model Integrating Retailing, Fintech, and

Forward-Looking Investments

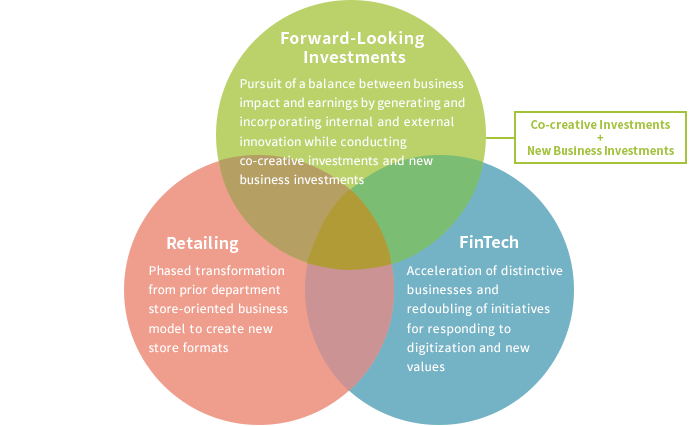

MARUI GROUP is pursuing higher levels of corporate value by developing a new business model merging retailing, fintech, and now forward-looking investments, which include co-creative investments and new business investments. Moreover, we aim to evolve into an intellectual creation company through forward-looking investments and other investments in intangible assets.

Retailing

MARUI GROUP's prior department stores are being transformed through means such as switching tenants to fixed-term rental contracts and expanding the range of foods and services offered. We are currently in the process of increasing the number of direct-to-consumer brand and other unique tenants that position stores as venues for providing experience value and engaging with customers. We thereby aim to create stores that do not sell. We are also arranging events that link online and offline spaces centered on our anime business and other new businesses in order to make our stores more enjoyable places that exert a strong pull to visit.

Stores

22 centered on the Kanto region

Transactions

¥229.2 billion

Annual store visitors

210 million

* The figure for transactions is from the fiscal year ended March 31, 2021, while the figure for annual store visitors is from the fiscal year ended March 31, 2020.

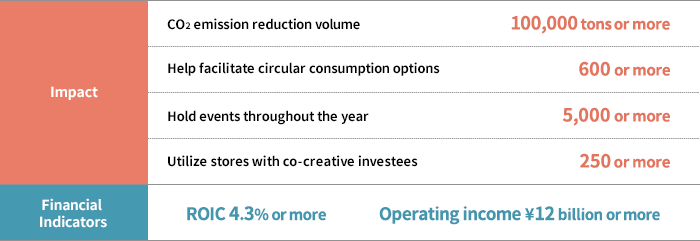

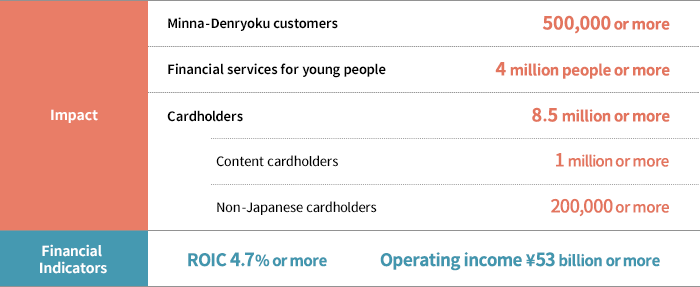

KPI Targets for the Fiscal Year Ending March 31, 2026

FinTech

MARUI GROUP advocates financial inclusion with the goal of providing everyone with the financial services they need when they need them, regardless of income or age. This goal has been the driving force behind our promotion of the co-creation of creditability since our founding. The co-creation of creditability entails providing everyone, even younger individuals with little income, with credit cards, and setting low credit limits when appropriate, so that we can build creditability together with them through a process of ongoing credit use and repayment. At the same time, we are deploying a strategy of maximizing our share of household finances in order to increase credit card usage amounts and forge longer relations with customers in our efforts to improve lifetime value.

Cardholders

7.1 million

Transactions

¥2,760.4 billion

* Figures are from the fiscal year ended March 31, 2021.

KPI Targets for the Fiscal Year Ending March 31, 2026

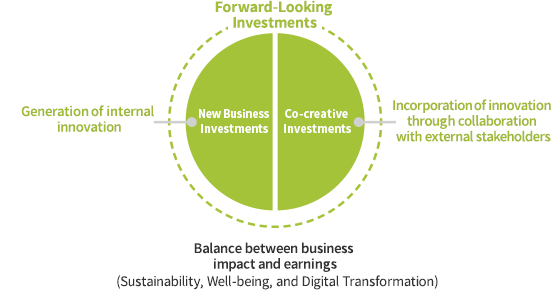

Forward-Looking Investments

Forward-looking investments refer to two types of investment: the new business investments we have been conducting to generate internal innovation and co-creative investments aimed at incorporating innovation through collaboration with external stakeholders. By promoting sustainability, well-being, and digital transformation through these investments, we will look to strike a balance between our business impact and earnings.

Investments in start-up companies

31

Co-creation teams

24 teams comprising

212 members

New business divisions

9

* Figures are as of October 1, 2021.

MARUI GROUP's Business

As a holding company, MARUI GROUP operates a conglomerate comprising the Company and 13 Group companies and affiliates. In the Retailing segment, the Company develops businesses including rental, operation, and management of commercial facilities; consignment agreement sales of apparel items and fashion accessories; store renovation; advertising; fashion distribution subcontracting; and maintenance and management of buildings and other facilities. In the FinTech segment, MARUI GROUP engages in credit card services, consumer finance loans, rent guarantee services, information system services, real estate rental, and other businesses.

- Relevant Links

-

- Investor Relations: President and Representative Director

- Investor Relations: Medium-Term Management Plan Report