CFO

September 2020

Difficulty in Accomplishing Major Medium-Term Management Plan Targets Due to COVID-19 Pandemic

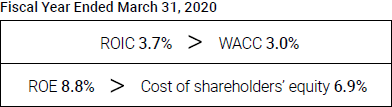

In the fiscal year ended March 31, 2020, the fourth year of the medium-term management plan, performance with regard to the key performance indicators (KPIs) of the plan was as follows: earnings per share (EPS) of ¥117.6, ¥5.1 lower than targeted; return on equity (ROE) of 8.8%, 0.4 percentage point less than our target; and return on invested capital (ROIC) of 3.7%, 0.1 percentage point below the target. In this manner, performance with regard to all KPIs fell below targets due to the impacts of the global COVID-19 pandemic, which occurred near the end of the fiscal year. Moreover, the pandemic reduced consolidated operating income by ¥1.3 billion through a ¥1.5 billion reduction in Retailing segment income coupled with a ¥0.2 billion increase in FinTech segment income.

The FinTech segment actually posted higher operating income as a result of the pandemic as we continued to record recurring revenue while a significant drop in new card issuance costs was seen. The impacts of the pandemic are expected to weigh even more heavily on the fiscal year ending March 31, 2021, the final year of the medium-term management plan. We have therefore judged that it will be difficult to accomplish the targets set for the plan's KPIs, namely EPS, ROE, and ROIC, in this year. We apologize for the disappointment this news causes.

MARUI GROUP will launch a new medium-term management plan in the fiscal year ending March 31, 2022. We hope to accomplish the goals of the current medium-term management plan, specifically EPS of ¥130 or more, ROE of 10% or more, and ROIC of 4% or more, as quickly as possible under the new plan.

Ongoing Corporate Value Creation through Earnings Structure Transformation

Regardless of the unfortunate performance, we were able to make steady progress in transforming our business model and earnings structure and in transitioning toward our target balance sheet based on the medium-term management plan. As a result, we have nearly completed the development of a structure that displays our desired corporate value, by which I refer to a structure in which ROIC exceeds weighted average cost of capital (WACC) and ROE surpasses cost of shareholders' equity on a consistent basis.

The most important goal of our earnings structure transformation is to be able to show growth in recurring gross profit and contracted future recurring gross profit,*1 which are important KPIs for management emphasizing lifetime value (LTV). Recurring revenue contributes to improvements in LTV. This form of profit has come to represent 65% of total gross profit, a level nearly double that seen before the start of the current medium-term management plan. Meanwhile, contracted future recurring gross profit, which represents gross profit to be recorded in future fiscal years, increased to a level that is 2.7 times greater than the amount of recurring gross profit recorded in the fiscal year ended March 31, 2020. This earnings structure is resilient to major risk factors, like the COVID-19 pandemic, and means that we should be less impacted by such occurrences than we would under our prior structure.

At the same time, we steadily moved forward with capital measures aimed at accomplishing our target balance sheet, resulting in a decrease in WACC and consequently a rise in corporate value through both improved profitability and reduced cost of capital. Furthermore, as recurring gross profit is recorded as the total for both the Retailing and FinTech segments, it is an ideal indicator for MARUI GROUP as it emphasizes LTV in its management through a business merging retailing and finance.

*1 Referred to as "contracted future recurring revenue" until the fiscal year ended March 31, 2020, to reflect future recurring revenue based on revenue as displayed on financial statements; referred to as "contracted future recurring gross profit" thereafter to reflect future recurring revenue based on gross profit

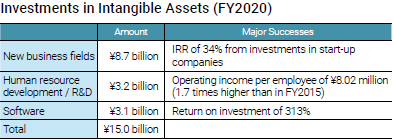

Increasing of Investment in Intangible Assets

In tandem with the implementation of our medium-term management plan, we have also been increasing investment in intangible assets for the purpose of fueling future growth. In the fiscal year ended March 31, 2020, investments in intangible assets amounted to ¥15.0 billion, twice as much as investments in stores and other tangible assets. Breaking down these investments in intangible assets, we directed ¥8.7 billion toward new business development, primarily through investments in start-up companies; ¥3.1 billion to software; and ¥3.2 billion to human resource development and R&D investments, which, although being recorded as expenses on the financial statements, are viewed as investments by us. Often times, we invest in start-up companies for the purpose of collaboration with the main businesses of the Retailing and FinTech segments, and we therefore anticipate returns through our business activities. However, we have also set an internal rate of return (IRR)*2 of 10% or more as a hurdle rate out of consideration for financial returns. The IRR on the ¥7.1 billion in investments conducted prior to March 2020 was 34%, greatly surpassing this hurdle rate. Software investments, meanwhile, have produced an exceptional rate of return on investment of 313% due in part to the fact that we conduct development in-house, which not only speeds up development but also creates such returns for our business. Human resource development and R&D investments include the cultivation of our IT staff and the secondment of employees to start-up investees, efforts we anticipate will increase corporate value over the medium-to-long term. These investments also contribute to ongoing improvements in operating income per employee, which was 1.7 times higher in the fiscal year ended March 31, 2020, than it was in the fiscal year ended March 31, 2015.

*2 Rate calculated using recent procurement prices for applicable marketable securities and based on amounts if listed stocks were to be sold at the end of the respective fiscal year

Outlook for the Next Medium-Term Management Plan

ROE was around 5% prior to the establishment of the current medium-term management plan, but the earnings structure transformations and capital measures conducted under the plan caused this indicator to rise to 9.1% in the fiscal year ended March 31, 2019, and 8.8% in the fiscal year ended March 31, 2020, coming in just below 10% in both years. Based on these trends, we will look to achieve an optimal capital allocation assuming ROE of 10% or more under the next medium-term management plan.

A central pillar of investment under the next medium-term management plan will be co-creative investment in start-up companies and other targets. In the new plan, we intend to double such investments from the level of the current plan, ¥30.0 billion over a five-year period. We can improve our success rate in co-creative investments by pursuing earnings contributions to our main business through collaboration with investees while also providing them access to our stores and other resources to stimulate their growth. We aim to maintain an IRR of 10% or more for financial returns through this approach. Moreover, by positioning co-creative investments as a central pillar of growth investments, we hope to create a situation in which ROE stays above 10% and ROE consistently exceeds cost of shareholders' equity. In existing businesses, investments will rise in the FinTech segment centered on software investment while investments in renovations in the Retailing segment will decrease as the transition to fixed-term rental contracts is winding down. As a result, overall investments in existing businesses will decline.

Taking this approach, investments in intangible assets, such as co-creative investments and software investments, will likely rise to account for around 80% of total growth investments under the next medium-term management plan. Through these investments, we will rapidly transform our business model to focus on intellectual creation driven by intangible assets.

- Relevant Links

-

- Investor Relations: Shareholder Return Policies