CEO

October 2021

Five Years Supported by Stakeholders

Nearly two years have passed since the outbreak of the COVID-19 pandemic. I would like to extend my sincere condolences to the families and friends of those who have succumbed to the virus and my thoughts and prayers to all those impacted by the pandemic. Our daily lives have undergone great change during the pandemic as we have faced various restrictions impeding our freedom of movement and other activities. A virus, a force of nature beyond human control, has brought society and the economy to a screeching halt. This unprecedented situation has provided us with a chance for introspection.

Many have taken this opportunity to reflect on their own lives or to look to the future, and these acts of introspection are gradually transforming the world. I believe that society is currently undertaking a bold change of course, redirecting its ship toward unknown seas and the paradigm shift that has been spoken of thus far. The pandemic still has no end in sight, and ongoing vigilance is required. Regardless, I am already confident that beyond this pandemic the world will take a course that is very different from the one we have followed up until now.

Amid this great upheaval, MARUI GROUP reached the end of its five-year medium-term management plan in March 2021. The progress of this plan was smooth through to its fourth year. However, the impacts of the COVID-19 pandemic in the plan's fifth year left our targets unmet. I would like to apologize for our failure to live up to the expectations of stakeholders. Regardless of this failure, a look back at these five years will reveal that we have accomplished almost all of the goals we put forth at the start of the plan. We completed the transition to fixed-term rental contracts in the Retailing segment, stabilizing earnings. We also began the move toward stores that do not sell. In the FinTech segment, meanwhile, we spread our network of EPOS card application desks across Japan, allowing us to effectively double our business scale. We also launched a new initiative not envisioned at the start of the medium-term management plan: cocreative investments. These investments allowed us to forge ahead with investment in and co-creation with start-ups while incorporating various new innovations. Also, on the environmental, social, and governance (ESG) front, we advanced an array of initiatives based on MARUI GROUP's 2050 Vision, which was announced in 2019. These initiatives have won strong praise, including the No. 1 ranking in the global retailing field in the Dow Jones Sustainability Index.

Our strong progress over these five years would have been impossible if not for the support of all our stakeholders, namely, customers, employees, investors, business partners, communities and society, and future generations. I am truly grateful for your support.

Concept of Ikigai Shaping Impact Targets

MARUI GROUP's journey to the future has only just begun. In May 2021, we unveiled our new medium-term management plan, which is meant to guide our journey to new heights. The new plan covers the five years leading up to 2026. The aspect of this plan that has me the most excited is the incorporation of the new concept of impact targets. The previous medium-term management plan was primarily focused on business strategies and capital measures. The new plan adds the perspective of our impact alongside these more conventional areas of focus. The idea of impact, which refers to the social changes brought about by our activities, has been an area of focus for NPOs and other agents of the social sector for some time now. MARUI GROUP is a for-profit company. We therefore have put our own spin on this idea. To explain our spin on this idea, I would like to have you look at some diagrams.

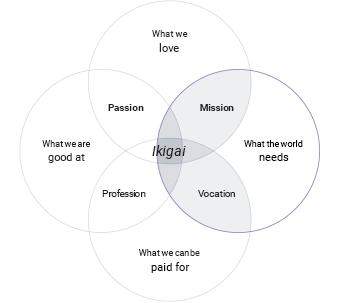

One of the diagrams we referenced when considering our impact was the Ikigai diagram, which I am quite fond of (see Figure 1). Ikigai is a Japanese word that refers to one's meaning for living. As shown in this diagram, Ikigai lies at the intersection of four factors: what you love, what you are good at, what you can be paid for, and what the world needs. What is most amazing about this concept of Ikigai is that its placing of true happiness at the intersection between our personal happiness and what the world needs coincides perfectly with MARUI GROUP's concept of promoting harmony between the interests of different stakeholders.

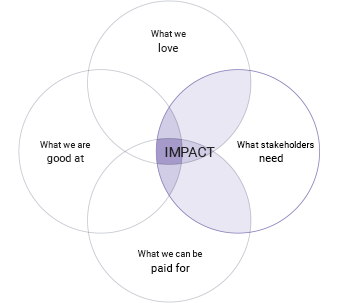

In tailoring this idea of Ikigai to MARUI GROUP, we reframed it from the perspective of a company, replacing the factor of what the world wants with what shareholders want. This reframing gave form to MARUI GROUP's idea of impact (see Figure 2). This idea is similar to the idea of purpose, which has been gaining a lot of attention recently. However, the idea of purpose refers more to one's personal sense of purpose. Different from this self-centric idea, our idea of impact is focused on stakeholders, looking at what we can do to respond to the needs and wants of stakeholders. I feel that this focus is more closely matched to MARUI GROUP's philosophy and corporate culture.

Figure 1: Concept of Ikigai Referenced When Defining Impact Targets

The intersection between the four circles in the diagram above represents Ikigai. This concept places true happiness at the intersection between our personal happiness and what the world needs.

Source: Ikigai diagram, Marc Winn, May 2014

Figure 2: MARUI GROUP's Idea of Impact

A major characteristic of MARUI GROUP's idea of impact is how it emphasizes what stakeholders want above what we love, what we are good at, and what we can be paid for.

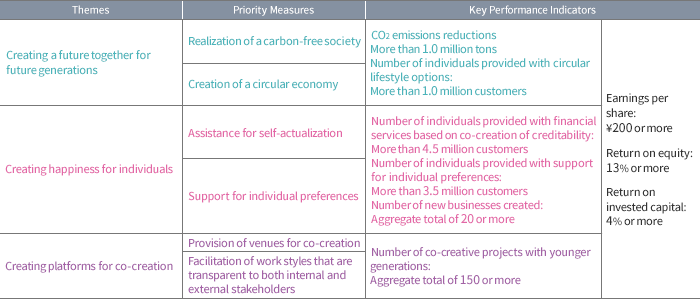

In this regard, MARUI GROUP has defined three impact targets together with six priority measures. The three impact targets are creating a future for future generation together, creating happiness for individuals, and creating platforms for co-creation (see Figure 3). We have also identified concrete initiatives to be advanced with regard to each of the six priority measures. Central to the formulation of these impact targets, measures, and initiatives was the development of a clear value creation narrative for increasing stakeholder happiness and interests. Our impact targets do not entail the de-emphasizing of shareholder interests for the sake of the happiness of other stakeholders. No, we must contribute to the interests and happiness of all stakeholders. Shareholders are, of course, stakeholders, and we must therefore realize the profits and capital efficiency that they expect. Our path toward creating this type of monetary value together with the non-monetary value sought by other stakeholders is our value creation narrative.

Figure 3: Clear Future Envisioned through Impact Targets

Plans for more specific initiatives and targets are currently being developed by the relevant Group companies and divisions with the goal of unveiling these elements within the fiscal year ending March 31, 2022. In other words, this new medium-term management plan will not be finalized at its start. Rather, we have developed a framework for this plan, which will be developed flexibly as an ongoing project while we move forward.

Governance Focused on Six Stakeholder Groups for Achieving Impact Targets

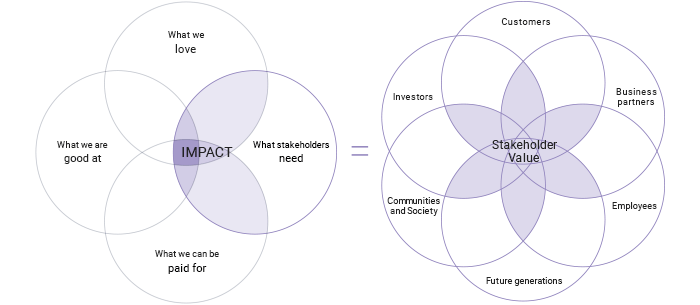

This new medium-term management plan is incredibly exciting for us. The reason for this excitement is that the approach toward management presented by the plan is congruent with the ambitions we have pursued thus far. Improvement of corporate value is a major management priority for MARUI GROUP. To us, corporate value entails creating harmony between the interests and happiness of all of our stakeholders and growing the intersection of these interests and happiness. Going back to the impact diagram, we see that our definition of our desired impact, the combination of what we love, what we are good at, what we can be paid for, and what stakeholders need, aligns exactly with our definition of corporate value (see Figure 4). This means that, for MARUI GROUP, our desired impact is equivalent to stakeholder value and consequently corporate value. Our approach toward management over the coming five years will be one that aligns with these three considerations.

Figure 4: Relationship Between Desired Impact, Stakeholder Value, and Corporate

The definition of MARUI GROUP's desired impact aligns perfectly with the Company's definition of corporate value as entailing creating harmony between the interests and happiness of all of its stakeholders and growing the intersection of these interests and happiness, and thus with the definition of stakeholder value. MARUI GROUP's approach toward management over the next five years will be one that aligns with these three considerations.

Our first step in practicing such management was to welcome stakeholders to the Board of Directors, which is the very heart of management. Specifically, we appointed Mr. Yasunori Nakagami, representative director and CEO of Misaki Capital Inc., as an external director to act as a representative for shareholders while also making sustainability expert Mr. Peter David Pedersen an external director. From within the Company, Dr. Reiko Kojima, a company physician and well-being expert, became our newest internal director. The corporate governance system created by the inclusion of these new directors will move us toward the approach for stakeholder-oriented management we envision. At the same time, we are also taking steps to incorporate elements of the Board 3.0 model, a new governance model being promoted that entails actively involving external directors in management strategy planning and other facets of management.

To this end, we have established the Strategy Committee as a new advisory body to the Board of Directors. This committee is chaired by Mr. Nakagami. Meanwhile, Mr. Pedersen has taken up the position of chairman of the Sustainability Committee, where Dr. Kojima serves as a member. Another member of the Sustainability Committee is Ms. Kyoko Ozawa, first chief future officer of Euglena Co., Ltd., who serves as a representative of future generations. These moves represent our efforts to practice the principles of stakeholder capitalism, an idea that began gaining global attention around 2019, as part of corporate management.

True Reason for Prioritizing Ongoing, Long-Term Dividend Increases

Some may wonder why we decided to invite shareholders to serve on the Board of Directors as part of practicing stakeholder-oriented management. One reason for this move is something that I touched on earlier: our approach toward stakeholder management is not one that denies the interests of shareholders. Rather, we look to practice management that emphasizes all stakeholders, including shareholders. However, that is not the only reason. We also believe that emphasis on the interests of shareholders will not necessarily lead us to neglect the interests of other stakeholders. In fact, it is true that shareholders are not a homogenous group. People often think of shareholders as being people among the wealthier classes, but there is actually a wide range of shareholders. For example, pension funds, such as the national Government Pension Investment Fund as well as the funds of companies, are also shareholders. The gains generated by the equity investments of these funds are used to pay the pensions of people today and will also fund the pensions of future generations.

I would like to take a moment to talk about one such shareholder: the AOI SCHOLARSHIP FOUNDATION. This public interest foundation was established by MARUI GROUP founder Chuji Aoi using stock he personally held, and it is currently our ninth largest shareholder. The AOI SCHOLARSHIP FOUNDATION uses dividend payments from MARUI GROUP to provide scholarships totaling ¥120 million to approximately 200 high school and university school students each year. I am one of the foundation's councilors. Supported by the strong performance of MARUI GROUP, we were able to offer scholarships to 70 new individuals during the fiscal year ended March 31, 2021, bringing the number of scholarship recipients to a new record high.

However, not all of my memories surrounding the AOI SCHOLARSHIP FOUNDATION are rosy. MARUI GROUP found itself facing a management crisis shortly after I became president. During this period, we posted two losses, forcing us to cut dividend payments to ¥14 per share, half the prior level of ¥28 per share. When I asked the secretariat of the foundation about their plans for the coming year after the cut, they said that the number of new scholarship recipients in the next fiscal year would be less than half of previous years. In my shock, I asked them why. The response was simple: MARUI GROUP had halved its dividend payments. Concern was also voiced that, if the low level of dividend payments continued, the foundation might be forced to reduce payments to both current and new scholarship recipients.

I was aghast. This was the first time I was forced to acknowledge exactly how reductions to dividend payments impact shareholders and those related to them. I thus pledged that, once we had recovered our performance, we would never lower dividend payments again. Since then, we have continued to prioritize ongoing, longterm dividend increases, raising dividend payments for the nine consecutive years following the recovery of performance, even in the fiscal year ended March 31, 2021, during which we were heavily impacted by the COVID-19 pandemic. My commitment to increasing dividend payments is underscored by the difficult realization from this experience. Accordingly, we cannot view management based on a dichotomy between shareholder interests and social contributions. It is not just scholarships that are affected by shareholder interests. The interests of shareholders are also connected to an array of social welfare frameworks, including pensions and insurance.

In this manner, the interests of shareholders are often directly linked to the interests of other stakeholders, and the interests of shareholders eventually affect the interests of society, which in turn then have an influence on the interests of shareholders. We therefore look to base our approach toward management on this relationship. I believe that this type of management is a responsibility of a listed company. By accomplishing our immediate goals and then taking the next step down this path, I hope to further facilitate stakeholder-oriented management by inviting representatives of future generations, customers, and employees to the Board of Directors.

Co-Creation with Younger Generations and New Work Styles

We have embarked on a new journey to achieve our desired impact. The part of this journey that I look most forward to is joining hands with others who share our philosophy and also seek the same desired impact. When we join hands with such individuals, we engage in the process of co-creation. MARUI GROUP's approach toward co-creation goes beyond simply passively responding to the requests of stakeholders; we seek to create the desired impacts by actively working with those who share our ambitions. In the past, we have practiced such co-creation when developing stores and products, and we have recently begun co-creation with start-ups. Through our co-creative activities with around 40 start-ups, we are pursuing open innovation, an approach toward innovation that has been deemed quite difficult, with few success stories to learn from. These efforts are spearheaded by more than 200 employees assembled to form co-creative teams as part of our committed approach toward co-creation, which is gradually producing results.

An area of focus going forward will be co-creation with younger generations. If we are to achieve our impact targets of realization of a carbon-free society and creation of a circular economy, we will no doubt need to call upon the strength of younger generations, who could be said to be sustainability natives. Moreover, we hope to offer assistance for self-actualization and support for individual preferences as priority measures for accomplishing our impact targets. Providing this assistance and support will require the use of technologies such as the internet, which lends itself to individual empowerment, and blockchain, which is driving the development of an independent and decentralized society. We have to practice co-creation with the digital native younger generations if we hope to effectively utilize these technologies.

To pursue such co-creation with younger generations, MARUI GROUP must embrace new work styles. This process should entail broadening our perspective. Rather than primarily requiring people to work inside the organization, we will need to promote more open work styles that allow people to work outside of the Company. Instead of mainly hiring new graduates, we should recruit mid-career individuals and adopt a wider range of employment styles to allow us to secure the ideal members for any given project. Such employment styles could include contract employees, individuals using us for secondary employment, non-traditional temporary employment schemes, and long-term internships. We also look to make our work styles such that talented and motivated individuals will be able to assume leadership roles regardless of their age or numbers of years of service. Ultimately, we want to develop work styles that frame collaboration as our business in order to pursue co-creation that blurs the boundaries of the Company.

These will not be easy tasks, and we cannot expect immediate results. Nevertheless, we are committed to gradually evolving to give rise to a co-creative ecosystem. I look forward to co-creating the future together with those who take an interest in our philosophy and desired impact after reading Co-Creation Management Report 2021.

- Relevant Links

-

- Investor Relations: Medium-Term Management Plan

- Investor Relations: MARUI GROUP's View on Corporate Value