CEO

August 2019

Co-Creation Management Report 2019 is our fifth co-creation management report. In this report, we will once again provide a look at MARUI GROUP's path to improved corporate value through financial and pre-financial information. At the same time, I would like to issue an invitation to anyone interested in co-creating this corporate value together with us.

Just like children invite their friends to join hands for playground games, we invite any of our diverse stakeholders who are interested in joining hands with us in co-creating value for the future. This invitation is issued to the customers who help us create better stores and services, the employees who work together with us, those who will join MARUI GROUP in the future, companies with which we engage in open innovation, long-term shareholders and investors, and every other stakeholder of the Company. This invitation inspired the photograph on the cover of this report. We hope that as many interested individuals as possible will join us in the serious but also fun game of co-creating value.

- New EPS Record for the First Time in 28 Years

- Accelerated Growth in Lifetime Value Stemming from Changes in the Nature of Sales

- MARUI GROUP's SaaS-Resembling Business Model

- Concept of Stores of the Future—Stores That Do Not Sell

- Distinctive Strategy of Maximizing Share of Household Finances

- Ethical Responsibility of Securing a Number of Forward Days for Future Generations

New EPS Record for the First Time in 28 Years

I would like to begin by looking back at the fiscal year ended March 31, 2019. We passed many milestones in this year. One of these milestones was the completion of the transition to shopping centers and fixed-term rental contracts that we started in the fiscal year ended March 31, 2015. Taking five years, the transition from department stores to shopping centers was a massive endeavor that transformed our prior business into something completely new. We were able to complete this undertaking thanks to the passion and dedication of our employees.

Meanwhile, EPOS card transactions exceeded ¥2 trillion for the first time, a notable milestone in the FinTech segment. After the launch of EPOS cards in March 2006, it took nine years before transactions through these cards climbed above ¥1 trillion in the fiscal year ended March 31, 2015; these transactions grew beyond ¥2 trillion a mere four years later. This success was a product of the accelerated growth we achieved through the nationwide deployment of EPOS card application centers and the promotion of Gold card issuance.

In terms of performance, these accomplishments led us to achieve operating income growth for the 10th consecutive year in the fiscal year ended March 31, 2019, and also to post a new record for earnings per share (EPS) for the first time in 28 years. As we grew our business and improved our earnings, we also worked toward our targeted balance sheet. These efforts helped us achieve return on equity (ROE) of more than 9%, which exceeded cost of equity, resulting in a positive equity spread and enabling us to finally generate corporate value that surpassed the expectations of our shareholders.

With a five-year average annual growth rate of 15.6% for EPS and a policy of targeting ongoing increases in the consolidated payout ratio, we have realized seven consecutive years of higher dividend payments combined with three consecutive years of new records for cash dividends per share. As a result, the Company's total shareholder return has grown by 2.7 times over the past five years, well above the Tokyo Stock Price Index average growth of 1.5 times over this period. Moreover, the average annual growth rate for total shareholder return was 22.0%, 14 percentage points higher than the Tokyo Stock Price Index average rate of 8.0%. Only two years remain in our current five-year medium-term management plan, which is slated to conclude with the fiscal year ending March 31, 2021. We are currently on course with regard to this plan, and we feel that the plan's targets are entirely within our grasp. As seen in these accomplishments, the fiscal year ended March 31, 2019, was a year during which much fruit was borne of our initiatives thus far.

Accelerated Growth in Lifetime Value Stemming from Changes in the Nature of Sales

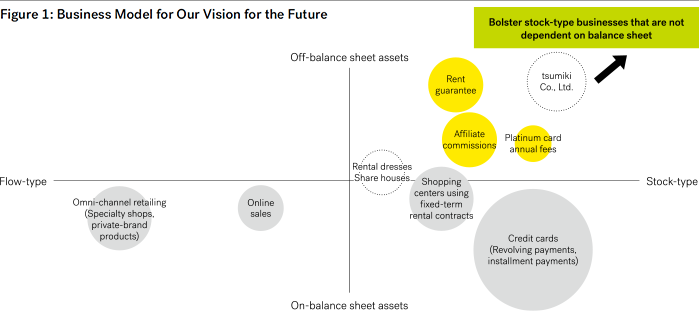

Next, I would like to review the status of MARUI GROUP's business model, which furnished the foundations on which we achieved this success. In last year's Co-Creation Management Report 2018, we described the business model we target as being characterized by transitions from a flow-type business to a stock-type business and from a business emphasizing on-balance sheet assets to one built on off-balance sheet assets (see Figure 1). These transitions are indicated by the two axes in Figure 1. Today, I would like to discuss the transition from a flow-type business to a stock-type business, the horizontal axis of this figure and an area in which we have seen great change over the past five years.

When we say a "flow-type business,"we are referring to a business in which the earnings structure is oriented around profits generated within a given fiscal year. In contrast, a "stock-type business"features an earnings structure centered on recurring revenue. Profits generated within a given fiscal year are those profits that are not guaranteed to recur in the following fiscal year. For example, when we operated department stores in the past, we had our regular customers along with a large number of other customers. Just because a customer made one purchase at our store, there was no guarantee that they would make subsequent purchases, meaning that we had to value each individual transaction. Moreover, the earnings of department stores were influenced by external factors, such as weather, trends, inbound demand, and consumption tax hikes, adding to the inconsistency of this business.

Our decision to transition to shopping centers and fixed-term rental contracts was predicated on our desire to move away from this inconsistent, year-by-year business to build a more consistent business structure. Changing the source of our earnings from sales revenues to rent revenues based on fixed-term rental contracts created a situation in which we can look forward to consistent rent revenues over a period of three to five years that is not influenced by external factors.

In the FinTech segment, meanwhile, the rapid growth in transaction volumes drove increases in consistent recurring revenues. The FinTech segment has always been in a position enabling it to achieve profits that continue beyond single fiscal years, through finance charges on revolving and installment payments. However, we have gone a step further by working to transform the nature of the transactions for which EPOS cards are used. We have thus sought to encourage customers to use their cards to make payments for communication fees, utilities, rent, and other ongoing payments in addition to one-time transactions at affiliates.

These efforts have caused the ratio of recurring revenue to total revenue to rise from around 26% in the fiscal year ended March 31, 2014, to approximately 54% in the fiscal year ended March 31, 2019. Revenue itself has increased for two straight years, but the growth in overall revenue has been outpaced by the growth in recurring revenue. This change is even more pronounced in regard to gross profit. Recurring gross profit accounted for 34% of total gross profit in the fiscal year ended March 31, 2014, and 63% in the fiscal year ended March 31, 2019. Over the past five years, overall gross profit has grown by 22% while recurring gross profit has risen by 230%.

In this manner, MARUI GROUP's earnings structure has undergone drastic change over the past five years, manifesting not only in stable growth in top-line revenue but also in the nature of sales. Rapid growth in recurring revenue is contributing to accelerated growth in lifetime value, the total of the present value of future profits (cash flows). As growth in lifetime value is directly linked to higher corporate value, one could thus say the MARUI GROUP's corporate value has improved greatly over the past five years.

MARUI GROUP's SaaS-Resembling Business Model

MARUI GROUP's business model is evolving beyond the prior model of combining, or perhaps synergizing, retailing and finance operations to become something resembling a software as a service (SaaS) model.* Comparing us to a SaaS company may seem like a little bit of a stretch. However, the business model of such companies is actually similar to a model we have been using for quite some time. Let me elaborate. It was apparently common for MARUI GROUP's founder to tell the former president that he should treasure the monthly installment payment business, as it was a lucrative business.

The reason monthly installment payments were lucrative was that they entail ongoing monthly payments after purchases, allowing for longer-term relationships to be forged with customers than would be possible under conventional retailing models in which relations end with single transactions. Also, under the monthly installment payment model, it is common for customers to make subsequent purchases after their payments have been finished. In this manner, MARUI GROUP's business was never a "one-and-done"retailing business, but rather was always a business of building long-term relationships off of single transactions.

I would like to share a recent episode in this regard. We recently asked the president of a certain start-up company to give a lecture. This president was born in Osaka. He called his mother the day before the lecture to tell her about it. At this point, his mother informed him that, when his father worked in Tokyo, he bought his first suit on installment payments from Marui. The president of this company was around 50, meaning that his father most likely bought that suit more than 50 years ago. I was moved to hear that our customers still remembered such interactions with us. The truth, however, is that there are many customers that have such memories. When I was a kid, I often heard adults speak of how they "had dealings with Marui."I had always wondered why so many people remembered their experiences shopping at Marui and expressed their experiences with the words "had dealings with."I found the answer when MARUI GROUP was grappling with a management crisis. The reason why these experiences remained with people for so long was because of the experience provided by monthly installment payments. Through this payment scheme, the co-creation of creditability with customers—our core value—had enabled us to forge strong, lasting relationships with our customers.

To use today's lexicon, this practice could be said to have been a form of "customer engagement."Such longterm relationships and strong engagement with customers are both characteristics of SaaS businesses.

MARUI GROUP's business takes place in an industry that is completely different from standard SaaS companies. However, the process of trial and error driven by our desire to translate the DNA we have held since our founding into a contemporary business has coincidently led to a business model that resembles that of SaaS companies. Today, MARUI GROUP is enjoying consistent top-line growth while evolving to employ a new business model that boasts rapid growth in corporate value on par with new companies. At the same time, we recognize that this new business model requires a new method of evaluating corporate value. For this reason, we will look to engage in dialogue with our shareholders and other investors in a manner that goes beyond the conventional industry categories of retailing and finance to co-create corporate value together.

* SaaS business models entail providing software and services through the Internet via cloud servers. Rather than purchasing packaged software, these models allow customers to choose their desired functions and use them on a subscription basis, thereby growing lifetime value through ongoing transactions with customers.

Concept of Stores of the Future—Stores That Do Not Sell

Now, I would like to talk about our vision for the future. I will be explaining this vision from the perspectives of stores, FinTech, and co-creation sustainability management. Beginning with stores, having completed the transition to shopping centers and fixed-term rental contracts, we are now poised to undertake the fullfledged development of the stores of the future. MARUI GROUP's business has evolved, taking us from running department stores to operating shopping centers. In the future, we will look to evolve beyond the boundaries of shopping centers to develop a completely new type of store—stores that do not sell. Delving into our concept of the stores of the future that do not sell reveals various new possibilities.

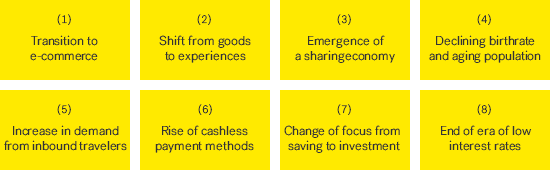

I will be explaining these possibilities in accordance with the eight operating environment changes described in Co-Creation Management Report 2017. The long-term trends pertaining to stores are primarily contained within changes (1)–(5). The concept of stores that do not sell has the potential to transform virtually all the threats associated with these changes into opportunities.

The long-term trend represented by operating environment change (2), the shift from goods to experiences, for example, would have presented a significant threat to MARUI GROUP if we had failed to move beyond department stores. This is because the business model of procuring and selling products utilized by department stores, while excelling at selling goods, is not suited to the provision of food and services. Shopping centers, however, employ a real estate rental model that is ideal for the supply of food, services, and other experiences. Still, both department stores and shopping centers share the same Achilles' heel: they are both focused on sales.

To move past this limitation, we chose to think about our future course while placing selling, previously assumed to be the fundamental role of stores, on the backburner. This opened the door for the provision of value in the form of experiences and communities. This is incredibly important because, as many have noticed, contemporary consumers desire the value offered by experiences and communities above that provided by goods and services.

This shift in contemporary tastes is even more apparent when it comes to operating environment change (5), the increase in demand from inbound travelers. It was only a few years ago when non-Japanese visitors to Japan would often plan their trips around shopping, purchasing electronics and luxury brand items in mass quantities. Today, such mass purchases are almost nonexistent, and we have seen a rapid shift toward the consumption of experiences, with visitors looking instead to enjoy Japanese cuisine, traditional culture, and anime or the natural splendor throughout the country. This shift mirrors the shift that the Japanese population underwent over the course of decades, only condensed into a few years. This different speed of these trends is itself a highly interesting subject. Back on topic, we cannot deny that Japanese people as well are trending toward the consumption of experiences. This trend can be seen in how the vast majority of photographs posted on Instagram are representative of the consumption of experiences. In response to this trend, we aim to evolve beyond shopping centers to create stores that provide not just goods but also experiences and communities.

If we decide that our stores do not necessarily need to sell, the potential influences of changes (1), the transition to e-commerce and (3), the emergence of a sharing economy will become quite different. Looking first at sharing economies, these economies are the antithesis of consumption and thus represent a threat to stores focused on selling, whether they are selling products or services. Conversely, stores that are not preoccupied with sales are able to synergize with these economies. We are therefore working to recruit partners that develop their businesses around sharing economies, which we expect will experience growth over the long term. In addition to collaborating with these partners in our stores, we will also coordinate to introduce EPOS cardholders to these partners, provide convenient payment methods, and offer other value. This approach has been adopted because we recognize that such sharing facilitation constitutes the type of sustainable businesses we hope to advance going forward.

The same can be said of e-commerce. Stores preoccupied with selling goods will be forced to compete with e-commerce, and brick-and-mortar stores will be placed in a disadvantaged position, as seen in the "Amazon effect" that has transformed the market in the United States. The shift from physical stores to e-commerce is a long-term trend that Japan will not be able to avoid going forward. In other words, the trend toward e-commerce is, quite possibly, the greatest threat to traditional stores.

However, this threat too can be transformed into a massive opportunity by putting sales on the backburner. The new e-commerce trend toward direct-to-consumer (D2C) businesses is emblematic of this opportunity. D2C businesses were conceived when the Internet enabled manufacturers to connect directly to consumers without having to go through the middleman of a wholesale or retail venue. Amazon and other e-commerce sites of the same vein are counted as "retail venues"in this case. D2C businesses may only offer a limited scope of specific products, but their offerings are unique and thus stand unrivaled. They are also able to win exceptional levels of consumer support by offering products not found anywhere else.

What is perhaps most interesting about this trend is how it is common for D2C businesses, a type of "second-wave" e-commerce business, to set up physical stores shortly after launch. One reason behind this drive to open physical stores is the fact that the fierce competition among e-commerce venders is driving sharp increases in new customer acquisition costs. More important, however, is the fact that the increased engagement made possible through direct interactions with customers via physical stores contributes to ongoing use by customers and subsequently higher lifetime value. In other words, D2C businesses see physical stores as venues for increasing engagement and promoting high levels of communication with customers. This business approach targeting strong engagement and long-term relationships with customers matches that of MARUI GROUP.

However, there is one obstacle to this approach. Department stores and shopping centers, which are exceptional at drawing customers, are focused on generating sales within stores. These stores are therefore not welcoming of D2C businesses. MARUI GROUP has thus stepped up to remove this obstacle. We hope to work together with a diverse range of D2C businesses that help enrich customer lifestyles. I therefore issue an invitation to such D2C businesses to join hands with us in creating value.

Distinctive Strategy of Maximizing Share of Household Finances

Moving on, we will now look at our future vision from the perspective of FinTech. I would like to take this opportunity to offer an update about our assessment regarding the opportunities and threats associated with operating environment change (6), the rise of cashless payment methods. In 2018, much attention was directed toward the advent of various payment services, which heralded a full-fledged transition to cashless payments. The advent of such services prompted many questions for a wide spectrum of stakeholders asking about the strategies MARUI GROUP would employ to combat new rivals such as IT companies pushing smartphone payment services. The common thread between these questions was the concern for the possibility of MARUI GROUP and its legacy credit card businesses being replaced by the innovative smartphone payment services of IT companies. We engaged in an active dialogue with shareholders, other investors, and employees for the purpose of responding to these questions and to this concern. Through this process, we were able to clarify the direction needing to be taken in the FinTech's strategies going forward, thereby deciding the core thrust of these strategies.

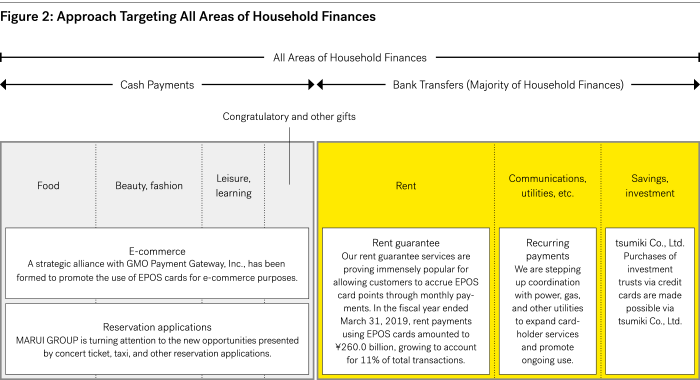

This thrust is the maximization of our share of household finances. Specifically, we aim to maximize the share of EPOS card payments in household finances by offering assistance in the various areas that customers use money (see Figure 2). As shown in Figure 2, the household finances of customers can largely be divided into two categories: cash payments and bank transfers. Companies promoting smartphone payments are primarily focused on the cash payments category represented by the left side of this figure. MARUI GROUP, meanwhile, is turning its attention largely toward the bank transfers category on the right side of the figure. This is because the right side primarily represents regular, ongoing payments that can help us generate the recurring revenue we target.

The most representative example of such ongoing payments is communications and utilities payments. We have long been encouraging EPOS cardholders to use their card to make these payments. In this area, we are looking to step up initiatives for promoting the use of credit cards to pay rent, generally the largest outflow as part of household finances. It is normally impossible to make rent payments with credit cards. However, we offer rent guarantee services that allow for credit cards to be used for such payments. These services have proved immensely popular as they offer customers the benefit of accruing EPOS card points each month as they pay their rent.

Furthermore, we advanced into the areas of savings and investment in 2018. Savings and investments are not technically outflows, and credit card payments have therefore not been applicable in these areas in the past. Our initiatives in this field will be advanced by tsumiki Co., Ltd., going forward (for more information on initiatives related to areas on the right side of Figure 2, please refer to "Progress and Future Strategies in the FinTech Segment").

Also beginning in 2018, we have been implementing initiatives for using EPOS Family Gold cards to convert all members of families into cardholders. Gold cards have substantially higher rates of ongoing use when compared to standard cards and also make large contributions to lifetime value. Given this fact, increases in the number of Gold cardholders will have an effect similar to growth in recurring revenue. As I have explained, our distinctive strategy is completely different from that of companies promoting smartphone payments. By advancing this strategy, we will turn the threats presented by the trend toward cashless payments into opportunities in order to improve corporate value by growing recurring revenue and evolving into a lifetime value-oriented business.

Ethical Responsibility of Securing a Number of Forward Days for Future Generations

Lastly, I would like to talk about the subject of co-creation sustainability management. MARUI GROUP was implementing environmental, social, and governance (ESG) initiatives previously. Seeking to evolve these initiatives to practice co-creation sustainability management, we devoted the year of 2018 to formulating a long-term vision and targets through discussion between employee volunteers and management.

These were compiled into our VISION BOOK 2050. This report describes MARUI GROUP's 2050 Vision: "Harnessing the power of business to build a world that transcends dichotomies."VISION BOOK 2050 also provides information on our three businesses founded on co-creation—inter-generational businesses, co-creative businesses, and financial inclusion—through which we will seek to increase the happiness of all people. Concrete initiative plans will be drafted over the period of 2019, through a process focused on employee volunteers similar to the one for formulating a vision and targets in 2018. In drafting these plans, we will use a backcasting approach.

There are two principles that I feel are important in these initiatives. The first is to practice co-creation with a new group of stakeholders: future generations. Previously, we have focused our activities on the five stakeholder groups of customers, investors, communities and society, business partners, and employees. However, discussions about a long-term vision and targets made me realize that there was one more stakeholder group we needed to consider in order to co-create value for the future.

This stakeholder group was future generations. I became aware of this group when examining environmental issues. One may wonder who are the stakeholders that benefit from environmental preservation. People often talk of "being kind to the earth"or "protecting the environment."However, it seems odd to think of the earth or the environment as stakeholders in the same manner as customers or investors. When pondering this quandary, the idea of future generations popped into my head. From a different standpoint, addressing environmental issues can be seen as preserving a rich and beautiful environment for the sake of children and younger generations. Rather than squandering this bounty, depleting and destroying the natural environment and resources in the process, it is an ethical responsibility to preserve this bounty for future generations.

Richard Buckminster Fuller defined wealth as the number of forward days we are physically prepared to sustain for future generations. Replacing this definition of wealth with corporate value is the core of MARUI GROUP's co-creation sustainability management. To practice this type of management, we will promote the contributions of younger employees and engage in open innovation with entrepreneurs. We also hope to take part in co-creation with junior high and high school students. I would thus like to invite junior high and high school students to join us in thinking about the type of businesses that will create value for the future.

The second important principle is how we will shape our business going forward. In Co-Creation Management Report 2018, we declared the goal of MARUI GROUP's new businesses as being to commercialize initiatives for addressing social issues. We have made true on this declaration as all of the new businesses we are currently advancing or developing are oriented toward the resolution of social issues.

Following the example of these new businesses, in the future, I hope to re-orient our existing businesses toward the resolution of social issues as well. One goal of our co-creation sustainability management is to have all of our businesses addressing social issues. Accomplishing this goal will align the meaning of our work with the meaning of our lives, thereby transcending the dichotomy between work and life. The structure of capitalism, which has maintained its hegemony since the industrial revolution, is reaching its limit. As the world is pressed to evolve toward a sustainable society, MARUI GROUP will strive to create value for the future as a frontrunner in co-creation sustainability management.

I look forward to your ongoing support and understanding and to engaging in co-creation with you.

- Relevant Links

-

- Investor Relations: Medium-Term Management Plan

- Co-Creation Management Report 2019: Target Balance Sheet

- Investor Relations: MARUI GROUP's View on Corporate Value