Three Businesses

- MARUI GROUP's Three Businesses

- Inter-Generational Businesses (Green Businesses)

- Inter-Generational Businesses (Initiatives Related to the TCFD—Disclosure of Financial Information Pertaining to Climate Change)

- Inter-Generational Businesses (Human Businesses)

- Co-Creative Businesses

- Financial Inclusion

- MARUI GROUP's Three Businesses

- Inter-Generational Businesses (Green Businesses)

- Inter-Generational Businesses (Initiatives Related to the TCFD—Disclosure of Financial Information Pertaining to Climate Change)

- Inter-Generational Businesses (Human Businesses)

- Co-Creative Businesses

- Financial Inclusion

Business Strategies

Scenario Adopted by MARUI GROUP (1.5°C Scenario)

Recognizing that a 4°C rise in the global temperature above pre-industrial levels resulting from climate change would have an enormous impact on society, MARUI GROUP believes it is important to work together to contribute to the movement seeking to limit global warming to below 1.5°C above pre-industrial levels. In order to facilitate our efforts to tailor our actions based on scenarios with increases below 2°C above pre-industrial levels (with a target of 1.5°C), we will identify the impact of climate-related risks and opportunities on our business and proceed to formulate relevant strategies.

Enhancement of Efforts Targeting 1.5°C Scenario

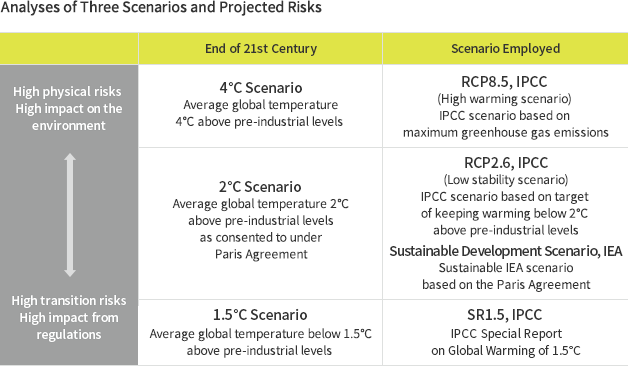

MARUI GROUP performed scenario analyses using three scenarios for 2050: (1) the world with average temperatures 4°C above pre-industrial levels described by the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA); (2) the world with average temperatures 2°C above pre-industrial levels based on the Paris Agreement; and (3) the world illustrated in the IPCC special report on the impacts of global warming of 1.5°C above pre-industrial levels.

MARUI GROUP's Business Strategies

MARUI GROUP aims to create a new business model integrating retailing and fintech with co-creative investment that fuels mutual development by investing in start-ups and other companies with which it can share its corporate philosophy and vision. Climate change poses such risks as damage to stores and other facilities from floods caused by typhoons and torrential rains and increases in costs due to the introduction of carbon taxes stemming from tightened regulations. Conversely, MARUI GROUP sees business opportunities to be seized by providing goods and services that respond to increased consumer environmental awareness and by investing in eco-friendly companies.

Analysis of Risks and Opportunities

MARUI GROUP has performed analyses of the potential impacts of climate change with consideration paid to climate change scenarios and other factors. Following these analyses, the estimated impacts on earnings leading up to 2050 were calculated based on the assumptions described below.

Assumptions

| Period covered | Present to 2050 |

|---|---|

| Scope | All businesses of MARUI GROUP |

| Calculation requirements |

|

Risks and opportunities associated with climate chang

| Changes in society | Risks faced by MARUI GROUP |

Description of risks | Financial impacts | |

|---|---|---|---|---|

| Physical risks |

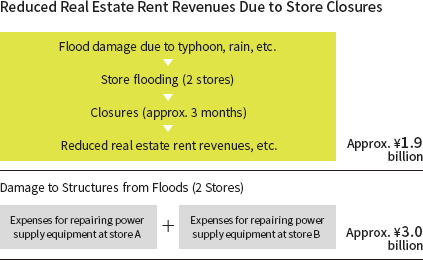

Flood damage due to typhoons, torrential rains, etc.*1 | Suspension of store operations | Impact on rent revenues, etc., due to business suspension | Approx. ¥1.9 billion |

| Building damages due to flooding (recovery of power supply facilities, etc.) | Approx. ¥3.0 billion |

|||

| Suspension of system centers | Groupwide suspension of business activities due to downed systems | Response completed*2 |

||

| Transition risks |

Increase in demand for renewable energy | Rise in renewable energy prices | Increase in energy costs due to renewable energy procurement | Approx. ¥0.8 billion (Annual) |

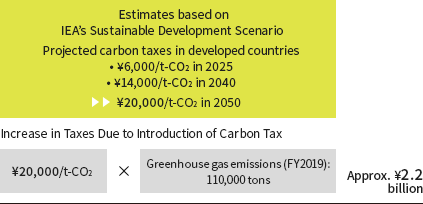

| Tightening of government's environmental regulations | Introduction of carbon taxes | Tax increase due to carbon taxes | Approx. ¥2.2 billion (Annual) |

| Changes in society | MARUI GROUP's opportunities | Description of opportunities |

Financial impacts | |

|---|---|---|---|---|

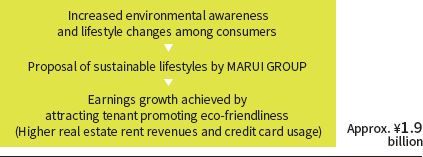

| Opportunities | Enhanced environmental consciousness and change in lifestyles | Propose sustainable lifecycles | Revenue from bringing in eco-friendly tenants, or other efforts | Approx. ¥1.9 billion*3 |

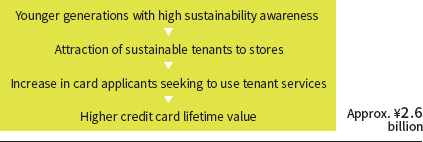

| Increase in sustainability-minded credit cardholders | Approx. ¥2.6 billion*4 |

|||

| Returns from investments in eco-friendly companies | Approx. ¥0.9 billion |

|||

| Response to demand from general households for renewable energy | Revenue from credit cardholders using electrical power from renewable energy | Approx. ¥2.0 billion*5 |

||

| Diversification of electricity procurement | Entry into the power retailing business | Reduced intermediary costs due to direct procurement of electricity | Approx. ¥0.3 billion (Annual) |

|

| Tightening of government's environmental regulations | Introduction of carbon taxes | Exemption from carbon taxes from achieving zero greenhouse gas emissions | Approx. ¥2.2 billion (Annual) |

- *1 Assuming flooding of a river that will have the most significant effects based on hazard maps (Arakawa River) (three-month effect on two stores in the watershed areas)

- *2 Assuming no financial impacts as a backup center has been established

- *3 Increased rent revenues and credit card usage

- *4 Calculated revenue from credit card admission and usage

- *5 Calculated revenue from increased Gold cardholders due to recurring payments, etc.

Climate Change-Related Risks

Risks associated with climate change include damage to assets from extreme climate events and other physical risks as well as transition risks brought about by changes in government policies and regulations. In the 1.5°C scenario, transition risks will be higher than physical risks, especially when compared to the 2°C and 4°C scenarios (see Co-Creation Management Report 2020 for more information). However, it can be expected that flood damage will be incurred as a result of sudden and severe typhoons and rains even if we are successful in limiting the rise in the global temperature to below 1.5°C above pre-industrial levels.

Physical Risks

– Store closures

MARUI GROUP operates stores and other facilities in its retailing business. Accordingly, it recognizes the risk of closures being seen at certain stores due to flood damage.

Transition Risks

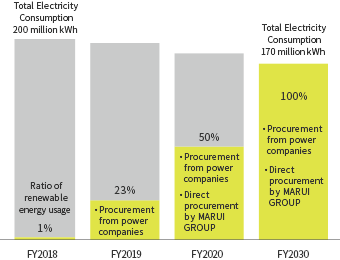

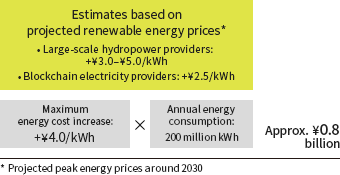

– Increases in renewable energy prices

It can be expected that renewable energy prices will increase as tighter greenhouse gas emissions regulations are implemented in conjunction with the move to realize a carbon-free society. Meanwhile, MARUI GROUP has announced its goal of sourcing 100% of the electricity used in its business from renewable energy by 2030. Accordingly, increases in renewable energy prices will have an impact on MARUI GROUP's finances.

Roadmap toward Goal of Using 100% Renewable Energy

Higher Energy Costs Due to Increases in Renewable Energy Prices

– Institution of carbon taxes

Based on the IEA's Sustainable Development Scenario, MARUI GROUP has estimated the potential amount of impact of increased tax expenses related to greenhouse gas emissions if the tightening of environmental regulations led to the introduction of a carbon tax in Japan and if the Company's rate of renewable energy usage were to decline to 0%. These estimates are as follows.

Climate Change-Related Risks

Climate change is expected to stimulate increased environmental awareness and lifestyle changes among consumers. Given this trend and the characteristics of MARUI GROUP's business, we anticipate that climate change will create various opportunities for us to take part in sustainable initiatives. Furthermore, new opportunities will likely also arise to be capitalized on by responding to the change in the electricity market and government environmental policy stemming from the popularization of renewable energy.

Proposal of Sustainable Lifestyles

– Earnings growth achieved by attracting tenant promoting eco-friendliness

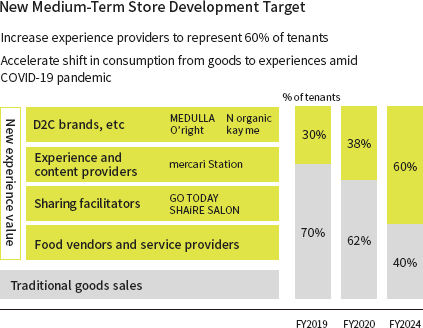

MARUI GROUP is advancing a store development strategy that entails actively attracting direct-to-consumer (D2C) and other tenants that offer eco-friendly products and services. We anticipate that increases in the numbers of such tenants will create opportunities for earnings growth.

– Increase in credit cardholders with high sustainability awareness

As younger generations with high sustainability awareness become more sympathetic toward the ideals of companies and tenants fighting climate change, it can be expected that we will see an increase in EPOS cardholders as customers apply for cards out of a desire to use the services of such companies and tenants. MARUI GROUP has calculated the long-term increase in earnings expected to result from this trend as follows.

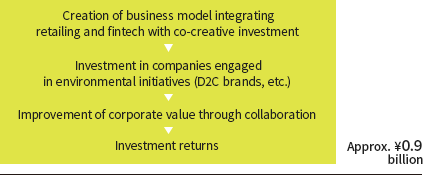

– Returns from investments in companies engaged in environmental initiatives

MARUI GROUP aims to create a new business model integrating retailing and fintech with co-creative investment that fuels mutual development by investing in start-ups and other companies with which it can share its corporate philosophy and vision. Potential targets for such investment include D2C brands and other companies engaged in environmental initiatives. MARUI GROUP has calculated the estimated investment returns from taking advantage of opportunities to invest in such companies as shown below.

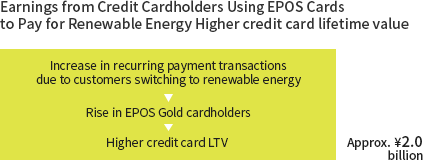

Response to Household Renewable Energy Demand

The rise in environmental awareness among consumers is expected to drive an increase in demand for renewable energy at ordinary households. MARUI GROUP is encouraging EPOS cardholders to switch to renewable energy. As shown below, we have calculated the long-term earnings estimated to be generated as cardholders increasingly use their EPOS card to pay for renewable energy on a recurring basis and are thus inspired to upgrade to Gold cards.

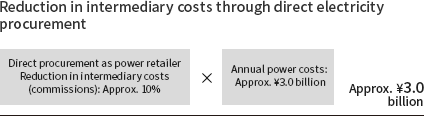

Entry into Electricity Retailing Business

Group company MARUI FACILITIES Co., Ltd., entered into the electricity retailing business in September 2019. MARUI GROUP has calculated the estimated reductions in electricity procurement costs to result from this move as follows.

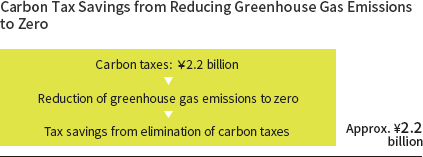

Introduction of Carbon Taxes

In July 2018, MARUI GROUP joined RE100, declaring its target of sourcing 100% of its electricity from renewable energy by 2030. MARUI GROUP has calculated the carbon tax savings estimated to be realized by accomplishing this goal and reducing greenhouse gas emissions to zero as follows.

Risk Management

MARUI GROUP performs scenario analyses to track and assess the impacts of climate change on its business and identify climate change-related risks and opportunities. The identified risks and opportunities are managed in terms of strategy formulation and individual business operations through a promotion system centered on the Sustainability Committee. Details on the deliberations of the Environment and CSR Committee, which comprises officers of Group companies (retailing, facility operation, distribution, building management, etc.), are regularly reported to and discussed at the Sustainability Committee, and reports and advice are provided to the Board of Directors as necessitated by specific items. Going forward, strategies and measures will be examined based on a myriad of factors. External factors on which information will be shared include climate change and other trends that may impact corporate strategies as well as legal and regulatory revisions. Internal factors examined will include progress in the measures of Group companies and future risks and opportunities.

Indicators and Targets

MARUI GROUP has defined environmental efficiency (the ratio of operating income to CO2 emissions) and the ratio of circular revenue (the ratio of circular sales and transactions to total Retailing segment transactions) as indicators for green businesses. The following targets for reducing Groupwide greenhouse gas emissions have been set: an 80% reduction in Groupwide total greenhouse gas emissions attributable to Scope 1 and Scope 2 and a 35% reduction in Scope 3 emissions from the level in the fiscal year ended March 31, 2017, by 2030 and a 90% reduction in combined volume of Scope 1 and Scope 2 emissions from the level in the fiscal year ended March 31, 2017, by 2050. These targets were certified by the Science Based Targets international initiative in September 2019 as targets for limiting global warming to 1.5°C above pre-industrial levels. Moreover, MARUI GROUP became a member of the RE100 initiative in July 2018, declaring its target of sourcing 100% of the electricity used in its business from renewable energy by 2030, along with a medium-term target of sourcing 70% of its electricity by 2025.

This sustainability website is designed to accommodate people with color blindness.