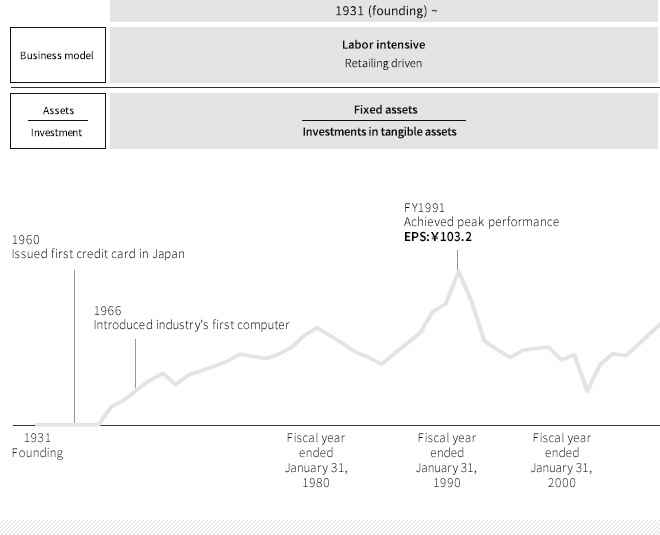

MARUI GROUP's History

Since its founding in 1931, MARUI GROUP has continued to innovate and evolve its unique business model, which merges retailing and finance, in line with changes in the times and in the needs of customers. Acting in accordance with the concept of co-creation of creditability—based on the belief of MARUI GROUP's founder that creditability should be built together with customers—we have continued to forge credit through trust built over long-term relationships by working together with and being empathetic toward customers. The founder also advocated a pioneer spirit of creating opportunities. This spirit propels us forward as we transform our business and create new demand and markets in response to changes in customer happiness or in society. Truly, this is MARUI GROUP's enduring founding spirit: its spirit of innovation and evolution.

Business Structure Transformation

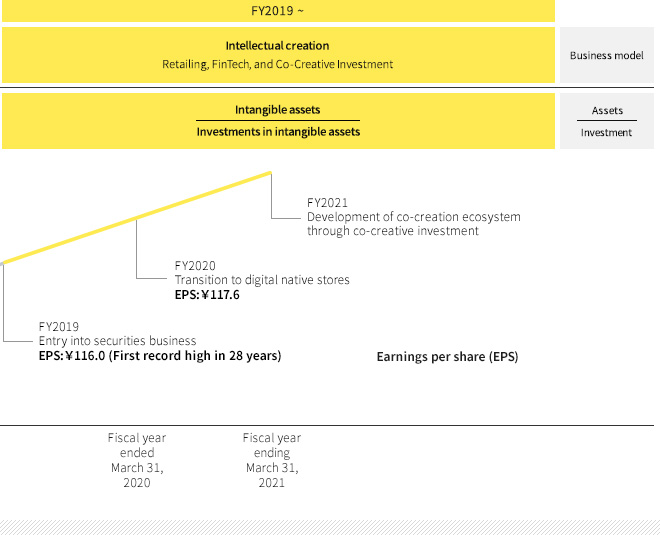

- Intellectual Creation Business Driven by Co-Creative Investment (2019 ~)

-

Period as president: 2005–present

Period as president: 2005–present

Third president: Hiroshi Aoi (16 years of service)As MARUI GROUP's capital-intensive fintech operations grew, the Company proceeded to invest in cultivating its IT staff while also directing investment toward direct-to-consumer (D2C) brands, start-up companies, and new business fields. This co-creative investment has come to stand alongside retailing and fintech as a third pillar of MARUI GROUP's business model. We have thus embarked on management aimed at developing an intellectual creation business through investment in intangible assets in order to create value that is greater than the sum of its constituents by pursuing synergies between these three pillars.

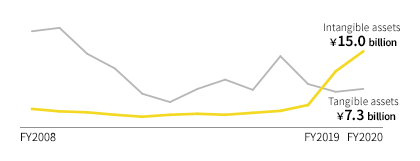

Investments in Intangible Assets Surpassing Investments in Tangible AssetsMore Information

- In the past, MARUI GROUP was primarily a retailer with financial functions with its credit cards serving to prop up its stores. Accordingly, tangible assets, such as the land and stores of its retailing operations, exceeded credit card operating receivables on the Company's balance sheet. However, this changed with the launch of EPOS cards in 2006. After this, card shopping transactions rose sharply, and credit card operating receivables came to surpass fixed assets in the fiscal year ended March 31, 2014. The transition to fixed-term rental contracts commenced in the fiscal year ended March 31, 2015, causing a decline in investments in stores and other tangible assets, while investments in fintech operations, co-creative investments in new businesses, and investments in human resources continued. As a result, investments in intangible assets surpassed investments in tangible assets in the fiscal year ended March 31, 2019.

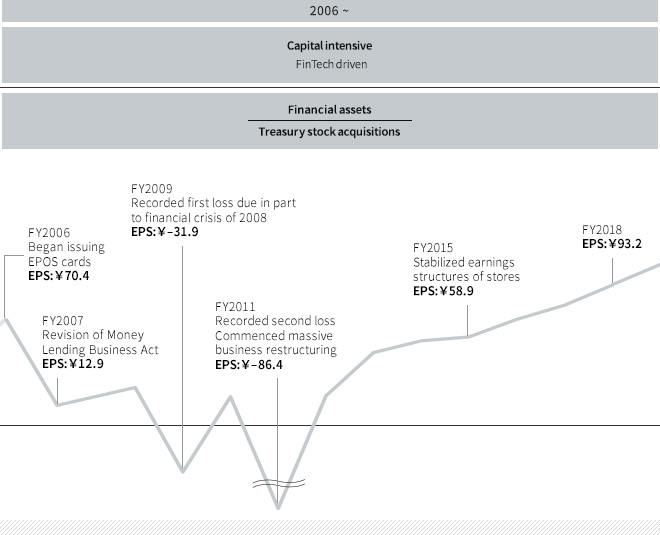

- Capital-Intensive Fintech-Driven Business (2006–2018)

-

After partnering with Visa Inc. to transform its prior in-house credit cards into multipurpose EPOS cards usable anywhere in the world, MARUI GROUP continued to develop its business model merging retailing and finance, but with finance replacing retailing as the main proponent of growth. The Company would later redefine its credit card business as a fintech business with the goal of providing financial services for everyone in response to the diversification of payment methods that accompanied the trend toward cashless payments.

Customers All ages (everyone) Products Lifestyle proposals Credit cards Multipurpose EPOS card Stores Shopping centers - Labor-Intensive Retailing-Driven Business (1931–2005)

-

Period as president: 1972–2005

Period as president: 1972–2005

Second president: Tadao Aoi (33 years of service)Income levels in Japan rose during the period of the Japanese economic miracle, causing the need for credit sales of durable goods to decline in the 1980s and leading other stores using the monthly installment payment system to abandon retailing to focus on finance. MARUI GROUP, meanwhile, turned its attention to the growing field of fashion. By providing credit to younger generations, we were able to include this previously neglected demographic and to innovate our business model merging retailing and finance without abandoning the retail side.

Customers Younger generations Products Fashion Credit cards Akai Card (Red Card) in-house credit card Stores Department stores -

Period as president: 1931–1972

Period as president: 1931–1972

Founder: Chuji Aoi (41 years of service)MARUI GROUP's business initially involved selling furniture through monthly installment payments. Furniture in those days was exceptionally expensive, meaning that some people lacked the on-hand funds necessary to purchase furniture. We sought to accommodate these customers by selling them furniture while at the same time providing them with credit. By lending money through monthly installment payments, we developed a business merging retailing and finance.

Customers New families Products Furniture, consumer electronics,

and other durable goodsCredit cards Japan's first credit card Stores Monthly installment payment stores